Archive

The Furriners are Coming

Where the money goes

We recently pointed out the irrationality of the current wave of anti-immigrant sentiment. Unfortunately, the outsiders amongst us have not done their case any good by providing the bulk of new babies born in Britain.

This raises the terrible spectre of an increasingly brown- and possibly Muslim– Britain, in which our cherished traditions like high tea and football hooliganism are threatened with extinction.

As the article linked to above shows, even the mainstream media is now unabashedly racist in its homilies. But even though the backlash against immigrant births is ludicrous (these newborn citizens are both consumers and productive resources), there is a kernel of sense to some objections.

The opposition Conservatives recently- and rightly- pointed out that the government’s massive spending on ‘social protection’ (see chart) creates harmful perverse incentives.

Child benefits incentivise people (immigrants or otherwise) to have children they would otherwise not have, and encourages teenage motherhood by externalising the costs of pregnancy. This is similar to how generous unemployment benefits actually keeps unemployment high by paying people not to work.

So the real scandal here is not that immigrants are breeding energetically. It is that we are paying people to abdicate personal responsibility for their lives- at a high cost to us all.

Absenteeism: Loving the Job You're With

Points for loyalty

Work, for most people, is a sadly necessary evil. We drag ourselves to the office like Shakespeare’s reluctant schoolboy, our offices looming ominously in our minds like today’s equivalent of Blake’s dark, Satanic mills. Which explains why we love weekends- and sick days.

Sometimes the weekend is just not enough to salve our souls. So we need a day off work to sit in the park, lie in bed, or just skive for the sheer rebellious pleasure of it. But the FT reports that over the past year, people have been taking fewer such liberties. Attendance is up, and for good reason.

Absence from the office is always politically risky: rivals find it easier to plunge the knife in you’re back when your away. The fact that you’re indispensable is also more obvious, and micromanaging bosses find themselves bereft without someone to torment, and so may take it out on you.

In a recession, with redundancies happening by the thousands, the risk of skiving becomes even higher. Thus the decline in sick days. It’s a sad confirmation that human beings, despite our wish to believe the contrary, are actually quite effectively motivated by the fear of negative consequences.

The report also reveals that women skive more than men, older workers are more dependable, and that despite their fatter pensions, civil service workers are the skivers-in-chief of the economy. Who would have thought?

The Self-healing Mr Market

Those who supported the unprecedented market intervention that will be forever remembered as The Great Bailout may soon come to reconsider their positions.

Those who supported the unprecedented market intervention that will be forever remembered as The Great Bailout may soon come to reconsider their positions.

As calm returns to the bourses of the world, and the frenetic panic of six months ago recedes into memory like a fading nightmare, a different terror looms. CNN reminds us that higher taxes must be the consequence of letting governments take good money they didn’t have and throwing it after bad.

Here in the UK, a concerted campaign to boost the taxman’s ravenous coffers is underway. It involves pillaging offshore accounts, raising the VAT rate, increasing income tax, and even topping up the fuel tax. Those who asked the government to intervene in the crisis will slowly realise that the tab is theirs to pay.

But was this intervention necessary? This can never be answered with finality because it is impossible to carry out a controlled experiment. In a crisis, we can’t have two economies: one with a bailout intervention, and the other left to the market, to see which turns out best in the long run.

But sometimes, the market does make it clear that he needs no intervention to heal himself. This refreshingly different article from CNN explains (in sadly excruciating detail) how lending markets self-adjusted both the availability and price of loan credit while the relevant government programs were still finalising their paperwork.

As we strain under the terrible fiscal consequences of The Great Bailout, it’s a salutary lesson to remember.

The End of Pensions

I relied on my pension.

Being paid for doing nothing is a great job if you can get it. And for decades, millions of people did just that- by drawing a pension. Those halcyon days may at last be over.

The idea of the pension is an anachronistic one, born in a prehistoric era when the British civil service comprised a tiny number of bureaucrats. It was an easy burden at the time for society to support them after retirement.

The largest businesses, confident of their eternal financial might, took on similar paternalistic obligations to employees, from the date of their first paycheck to the day of their final internment.

How vain those notions now seem. Globalisation, competition and the creative destruction of modern capitalism have punished any corporation with the hubris to assume it can bear the cost of both current and past employees. The defined benefit plans of old have long been giving way to defined contribution plans, and the pace of their extinction is being hastened by the current crisis.

Barclays has realised the stark reality of pension fund deficits. RBS too is smelling the coffee. Costain is facing stark reality, and even the government is floating the first tentative hints of imminent reform to civil service nest eggs.

Pensions are a relic of a musty time long past. For today’s worker, the writing is on the wall: save for your own retirement, or you might wish you had.

FT Recommends Shotgun for Serial Killer

Greenspan's Folly

President Obama has poured calming oil on the turbulent financial markets by announcing early his reappointment of Ben Bernanke to the Federal Reserve Chairmanship.

What he hasn’t done is explain how he will prevent the Fed from causing another global financial crisis. Which of course is not how many pundits see it.

Having been litter-trained by the media to blame the crisis on the banks, they obediently repeat the party line that what is needed is more power for the Fed to keep the evil bankers in line.

This fallacy is the thrust of this uncomfortably trite article from the FT. We beg to differ. The crisis saw an unprecedented coincidence of bubbles: an oil price bubble, a real estate bubble, a stock market bubble and a commodity price bubble simultaneously. This can happen only when cheap, plentiful money is chasing every asset in sight.

It’s like brothel prices when when a boatload of lonely sailors comes ashore. And in this case, the price (and quantity of money) was controlled not by the banks, but by the Fed.

Alan Greenspan’s low interest rates between 2000 and 2004 (see chart) were an overreaction to the 2000/2001 recession. As money poured in from China to boost the flood of cheap funds, there was no-one to tell Greenspan to raise rates and curb the flood: the Fed is an unaccountable, powerful cabal ruled by an omnipotent Chairman. Curbing this power should be the real focus of reform.

Whitewashing Corporate Culture

Wouldn't it be lovely

Have you caught yourself saying ‘Chairman’ instead of ‘Chairperson’ and been mortified by your callous disregard for the niceties of gender sensitivity?

You shouldn’t be so hard on yourself. Modern business is being beset by politically-correct diktats that make that gaffe seem minor. We recently heard about a corporation that disallowed the use of the term ‘brainstorm’, because it was apparently insensitive to people with epilepsy. But even that has been recently dwarfed.

Some government quangos are recommending a ban on terms like ‘gentleman’s agreement’, ‘right-hand man’, ‘black day’ and ‘master your brief’ on the grounds that they perpetuate negative racial or gender connotations.

Rising to this stirring challenge, we would like to suggest these additions to the list: Master of the Universe, Black sheep, Blackball, Slide Master, Black looks, Black book, Black mark and Taking it like a man.

But seriously. Though these measures are on the face of it ridiculous- not to mention personally oppressive of employees’ right to work in an atmosphere not reminiscent of a Fascist labour camp- there is some merit to the madness. Prejudice is real in our workplaces, and true ethnic and gender diversity in senior management a long way away.

The market may correct this over time, but sometimes it needs a little push. When people are forced to be politically correct, it soon becomes a habit, and people eventually become defensive of their own habits. What they’re forced to do today, they’ll enthusiastically defend tomorrow.

Immigrants Again

Leggo my benefits!

Immigrants, of course, are the real cause of this economic crisis.

And unsatisfied with leading the world to the brink of financial ruin, they exacerbate the chaos they created by leeching off social benefits, committing crimes, and taking jobs that should be filled by good, unemployed Britons.

Or so the story goes. For as long as humans have lived in social groups, immigrants have borne short shrift during recessions. The genesis of anti-Semitism was the belief- or at least charge- that Jews tended to profit financially from the financial misery of others.

In times of economic stress, people switch to ‘scarcity’ mode. The instincts that helps us survive famine and drought for six million years kick in, and reason goes to sleep.

This is expressed in an illogical desire to keep the ‘outsiders’ away from the dwindling food supplies. It’s illogical because immigrants are not only consumers, but also economic resources (thus contributing to economic growth). And open borders work both ways: immigrants who can’t find jobs tend to go back home, meaning the most productive- or determined- tend to remain. And surely, those are the kind we want.

Nonetheless, politicians are paid to pander, and so despite the warnings of well-meaning advisers, the rules on immigration have been tightened. Consequently, skilled immigrant numbers are falling. A global economy offers a global labour pool and a more efficient market for skills. Anti-immigrant rules make us all poorer at a time when we need productive and motivated human resources the most.

The Hangover

Beware the morning after.

First the revelry….then the headache. In recent weeks, the markets have lurched in fits and starts, like a drunk after a particularly riotous bachelor party. And the fog cleared from its aching head, it seems to have come to the conclusion that the party is just beginning.

If only. Even as a consensus emerges that the recession may be bottoming out, the powers that be cast a dark pall over the revelry with a grim promise: the riotous excesses of the bailout are going to cause a hangover of monumental scale.

First, there’s the matter of interest rates. The Bank of England has flooded the financial system with a sea of cheap money, to keep us spending furiously. Deflation was deemed a lurking terror to be banished by patriotic consumption. But eventually, interest rates have to rise, as this article notes. We simply have to save more.

What is more, as the gargantuan scale of government deficits becomes obvious, it’s clear that with so much money being sucked out of the financial system into the government’s black hole of a deficit, the cost of money must rise as the rest of us compete for what little is left.

Then there are taxes. The VAT holiday is ending, unlikely to be renewed. Higher VAT is unlikely to boost patriotic spending. The cash for clunker bribe scheme is likewise ending. The US Fed, like the BoE, must start planning to take back the money flood, lest they stoke another bubble. Party’s over, hangover starts.

Marriage, Incentives and Externalities

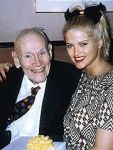

Rational decision-making

In these times of high unemployment, would you take the following job?

You’re an uneducated nobody at the bottom of the food chain. You live in a council flat. The job involves living luxuriously for 16 years, mixing with the cream of society. At the end of the assignment, you get an £8m payout, with a £600k pension for 7 years.

The job, of course, is wife to celebrity John Cleese, and the pension payout is the divorce settlement. Divorce laws raise the fascinating issue of financial (dis)incentives: how peoples’ behaviour changes when a sufficiently large financial payoff (or penalty) is on offer.

For example, a broken ATM dispensing extra money in London showed people would queue for hours for ‘free’ money. Or at least, until the value of time spent queing equals or exceeds the potential cash payout.

Similarly, interestingly, divorces tend to fall during the recession. Why? When cash is tight, the high financial cost of divorce seems a greater disincentive compared the the benefits of separation, so people stay put.

The broader social implication here is that, by making marriage potentially profitable for women, the UK’s divorce laws create an incentive for rational women to choose marriage to a successful man over developing a career or starting a business. The result is a demeaning reinforcement of gender workplace inequality, pay gaps and glass ceilings.

The so-called gold-digger is merely responding rationally- and predictably- to a powerful legal and perverse incentive.

When the Tide Goes Out, Frauds Come Out

Why you hope the tide stays in

“It’s only when the tide goes out that you learn who’s been swimming naked“- Warren Buffett

Financial Crises like the current one bring a cold kind of justice to financial markets. Over-leveraged investments and sophisticated financial chicanery blow up magnificiently. Ponzi schemes unravel, as investors ask for their money back.

But even more mundane crimes come to light. As corporates watch their cash more closely, petty frauds see the light of day: the person with their hand in the till is caught in flagrante delicto. This season is no different. However, in keeping with the enormity of the financial collapse, new records for money crime are being set.

Bernie Madoff’s world-record Ponzi scheme is already old news. What is new news is the world’s largest identity theft operation. 130 million credit card numbers harvested in a monumental hack of retailers’ computer systems that makes fiddling with your expense claims seem positively saintly by comparison.

The more seedy side of crime is evident too. In a world of electronic and plastic payment, why does anyone use cash? Largely because it’s anonymous. Which suggests that a large volume of cash transactions are concentrated in illicit businesses like drug-dealing.

This theory is confrmed by the finding that up to 90% of paper money in the US is tainted by illegal drugs. Cash is king, indeed.